How to Build a Results-Focused Investment Portfolio to Attract Finance

First and foremost, the usual reason we create any portfolio is to get funding for that next property project.

The task however can seem daunting when starting from scratch. In my time designing investment portfolios, I’ve noticed people in property really appreciate guidelines around:

A: what content/data to include in a portfolio

B: what order to put that content in that creates the most appealing offer for the investor

So in this article, we’re going to build it.

Let’s keep in mind one thing before getting to work – investor attention. We want to create a concise, easy to digest portfolio that makes it easy for the investor to grasp a few things:

- How investable you are and your risk factors

- What you actually want from the investor

- Your outcomes

- How to take the next step

Let’s go.

Overall structure (in order)

1 – Cover sheet

2 – Contents page

3 – Introduction page

100-200 words, 1 page plus images of people in your business

Introduce your business and the people within it – how long have you been operating, what is your background, can you demonstrate expertise in this section relevant to property?

4 – Vision Mission + Values

150-250 words, 1 page plus one or more images of a finished project

Divide this content up to three groups, outlining your overall goals

e.g. ‘to create design-led homes that minimise their impact on the environment’

Your mission and goals should be inclusive of your investor who is reading this – how are they involved in making this happen?

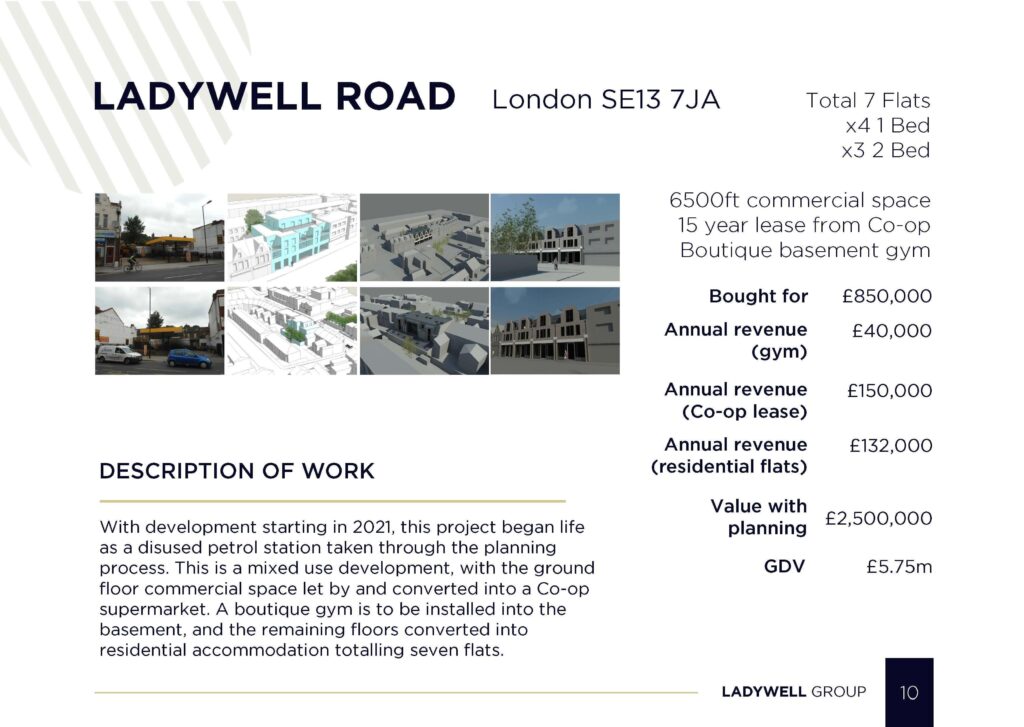

5 – Written Content About Your Past Projects / Case Studies

150-200 word per project plus financial data and relevant images

Limit 1 project per page, no more than 5 projects unless essential to include more.

Project Overview: Provide concise descriptions of each property investment.

Include completed and ongoing projects with before and after photos.Numbers: Highlight data about each (choose whatever is relevant):

Land

Purchase Cost

Refurb Cost

GDV

Fees

Rent / Sale

Loan amount and ROI

Current state of property – is it rented, sold or otherwise

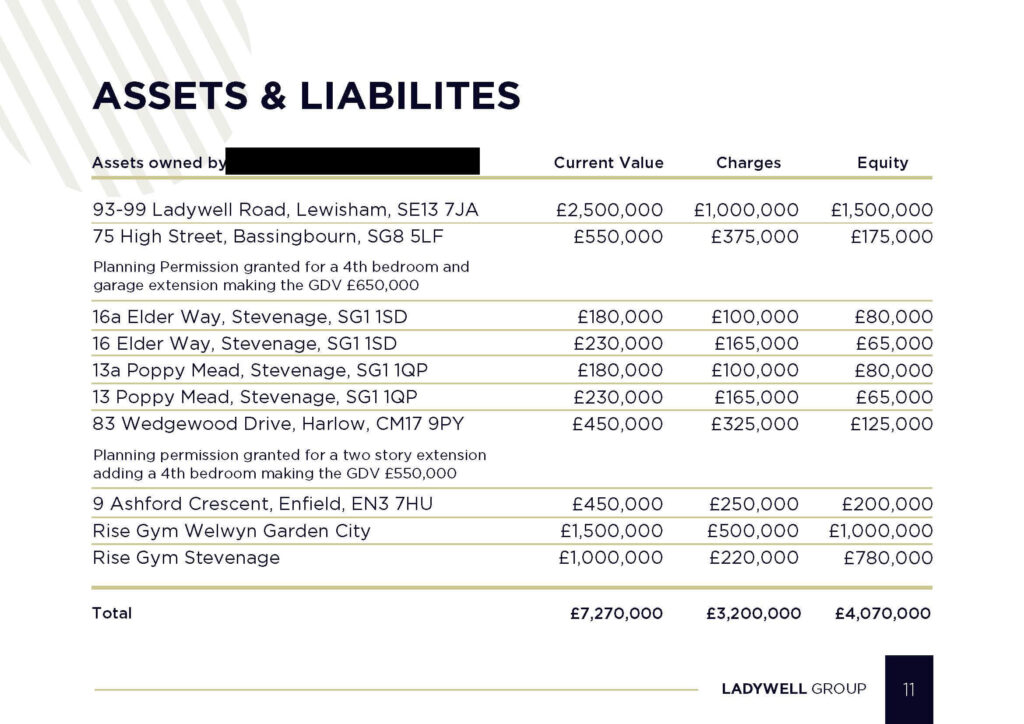

If you have commercial property it may be relevant to include Annual Revenue, Value with Planning and assets and liabilities.

6 – The project itself you require investment for

As many words as necessary, 1-2 pagesWhat is the project in detail?

What are projected timelines and milestones?

What is the end goal and over what period?

7 – The Investment offer – Getting the Numbers Clear

As many words as it takes but focus on formatting tables with your £ numbers as a priority, 1 page

Objectives: what are you doing with the funding you desire?

Accuracy is Key: Collate all relevant all financial data is accurate and up-to-date.

Return on Investment (ROI): Highlight projected ROI figures and the timeline for when and how that ROI is paid

ROI type: expand on profit share, equity, fixed return monthly etc.

Cost Analysis: Include detailed breakdowns of what the investment will be spent onOutline minimum investment requirement

Outline onboarding: how does the investor come into this project

Outline investor involvement: communication/site visits etc.

Include a visual roadmap if you need to including timescales

8 – Risk factors, security and exit strategy

300-400 words, 1-2 pages

What are the risks you have identified for the project(s) you seek funding for?

And how do you plan to mitigate those risks?

What is the risk factor for the investor?

What is your exit strategy for the project(s) you need funding for?

What security can you offer the investor?

What are the exit strategies you can guarantee the investor? VERY IMPORTANT

9 – The future:

Growth Projections: Present realistic, data-backed growth projections that show you’re forward-thinking but will also encourage a long-term, repeatable investment strategy for you and your prospective investor.

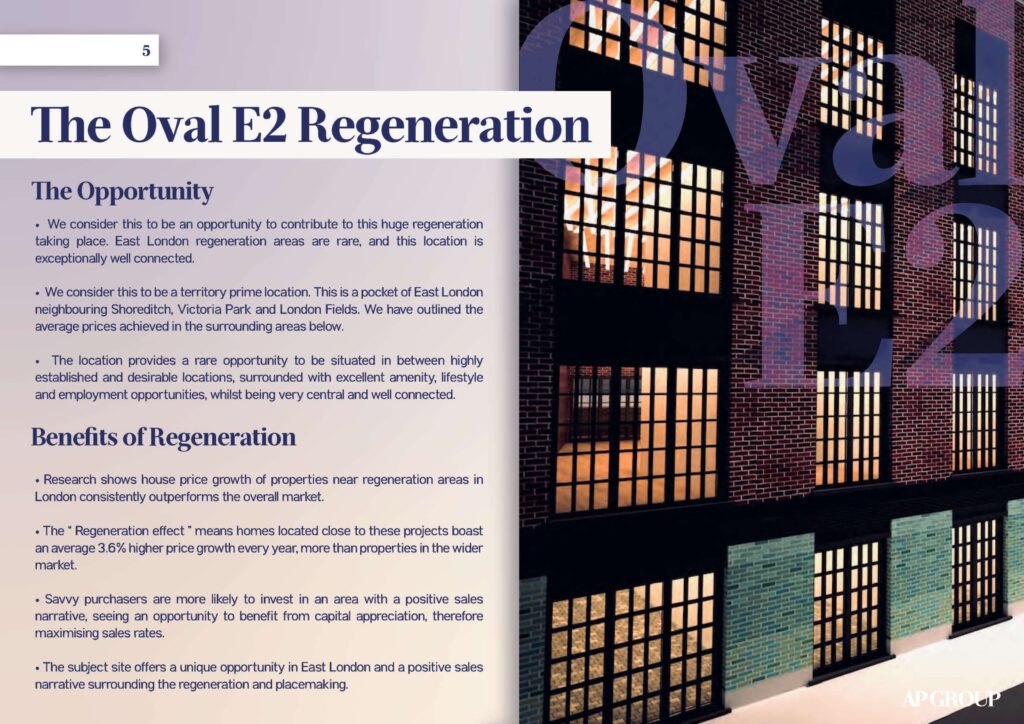

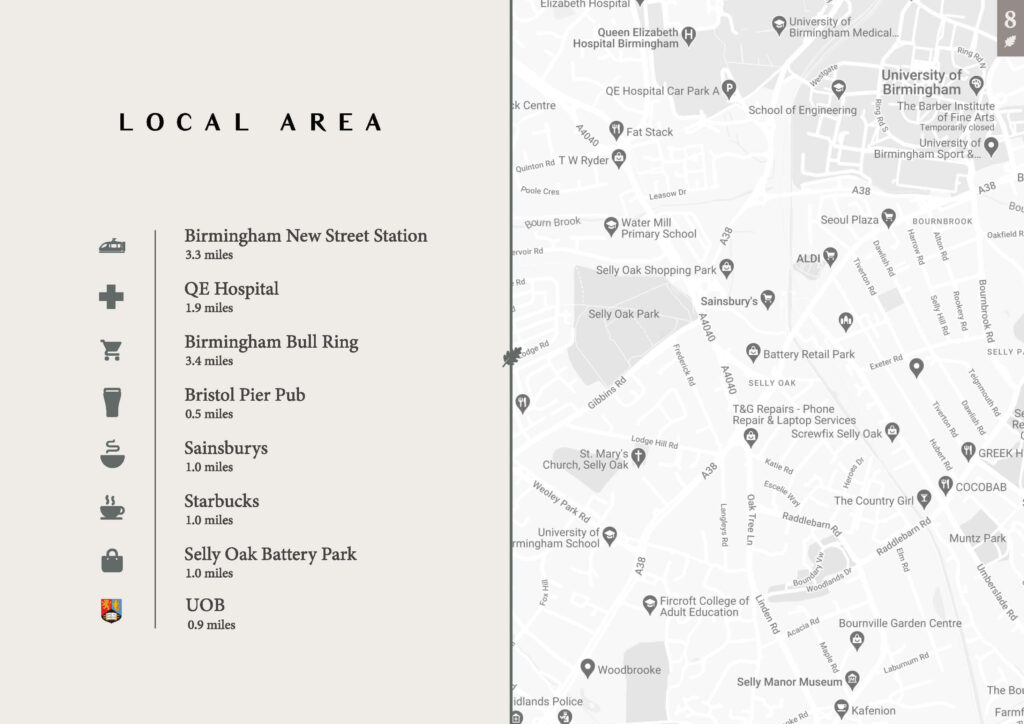

10 – Demand and socio-economic factors

200-300 words, 1 page

Back up your confidence in your project by providing data and insights into the demand around your project.

Location

Comparables

Occupancy demand (if relevant)Housing data from local authorities

Potential roadblocks you foresee/will overcome

Trends, market updates and economic factors that are relevant

Any other relevant information

11 – Social proof (optional)

100-200 words plus relevant images / screenshots, 1 page

You may be well placed to reach your goals via social media exposure. For example, from your previous projects you might have attracted 60% of your Student Comms occupancy via Instagram and LinkedIn posts.

If this is relevant, it is worth highlighting your social reputation if it has a significant bearing on reaching your project goal that would in turn, increase investor confidence in you.

12 – Contact information

50-100 words, 1 page

Provide straightforward contact points for the investor – include your social media accounts, email, phone number and website link.

Building a results-focused investment portfolio requires a strategic approach, prioritizing clear, accurate financial data and engaging content before design elements. By following these guidelines, your portfolio will not only attract but also retain the interest of potential investors, setting the stage for successful property investment ventures.

Design is the final touch

Should you hire a designer to help you build an investor portfolio? Of course I’m biased to say yes, but only once you have your content in order and properly written.

My job is to:

Ensure your document has Brand Consistency: Ensure the design aligns with your brand identity.

Simplicity and Clarity: Designing a clean, uncluttered design.

Engaging but Not Overpowering: Design should complement, not overshadow the content.

Accessibility: Make sure the design is accessible and easy to navigate especially on mobile devices.

Rich Devenport – Founder

Studio Key / @prop.designer

Comments