Forget the overheated property markets of the south, Birmingham and the West Midlands are shining beacons for savvy investors seeking sustainable growth and outstanding returns. Packed with potential, this dynamic region offers a compelling combination of a thriving economy, a booming population, and surprisingly affordable property prices.

Let’s delve deeper into why Birmingham and the West Midlands should be at the top of your investment list:

Economic Powerhouse: Step aside, London! The West Midlands boasts the second-largest economy outside the capital, brimming with diversity and resilience. From the heritage of manufacturing and automotive giants to cutting-edge aerospace and tech industries, the region is a hotbed of innovation and job creation.

Unemployment rates are consistently below the national average, attracting both domestic and international investment, ensuring a stable and prosperous environment for your assets.

A Flourishing Future: Growth is not just a word, it’s the West Midlands’ reality. The population is projected to surge by 1.5 million by 2030, fueled by inward migration, a growing elderly population, and natural births. This translates to increased demand for housing, creating a perfect storm for lucrative rental yields and capital appreciation.

Affordability’s Oasis: Unlike the skyrocketing costs of other major cities, Birmingham and the West Midlands offer a refreshing haven for property investors. Homes here are significantly more affordable compared to their southern counterparts, allowing you to stretch your budget further and maximise your returns. Invest in a spacious apartment in Birmingham’s vibrant Jewellery Quarter, or a charming family home in leafy Solihull – the choice is yours, and your wallet will thank you.

Connectivity at Your Doorstep: Isolation? Not in Birmingham! The city boasts excellent transport links, connecting you seamlessly to the rest of the UK and Europe. International airport, a robust rail network, and major motorways put the world at your fingertips, ideal for businesses needing to move goods and people efficiently.

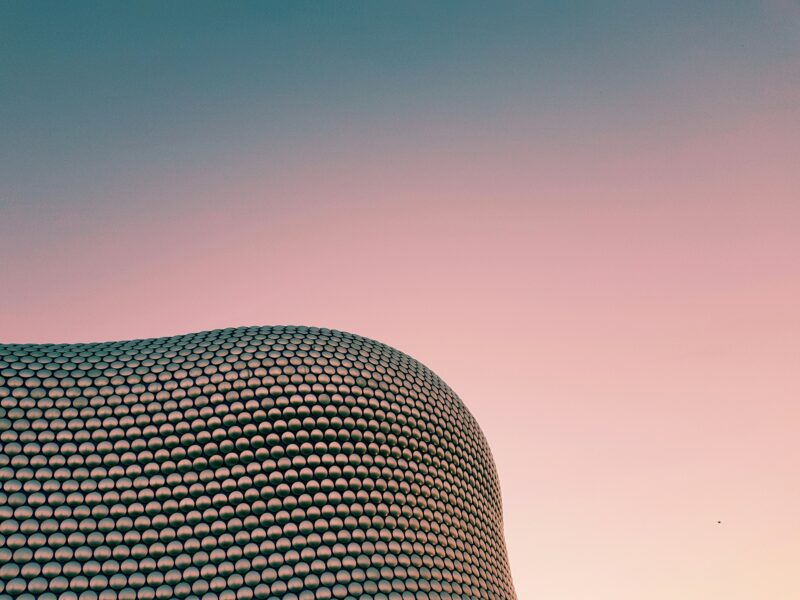

Living the Dream: But Birmingham isn’t just about business; it’s about lifestyle. From the world-renowned Symphony Hall to the contemporary Bullring shopping centre, the city buzzes with cultural offerings and diverse entertainment options. Green spaces like Sutton Park provide tranquil escapes, while countless restaurants and bars cater to every taste. And let’s not forget – Birmingham is consistently ranked as a safe and welcoming place to live, putting your mind at ease.

Property Paradise: The region enjoys a strong rental market, ensuring consistent income from your investment. Whether you choose a modern city centre apartment or a charming period property in the suburbs, demand for high-quality housing remains high.

Beyond Bricks and Mortar: But Birmingham’s investment potential extends beyond traditional buy-to-let. The region is a breeding ground for innovative startups and established businesses. With major infrastructure projects like HS2 and the Birmingham City Centre Masterplan on the horizon, the future is looking bright for forward-thinking investors.

The Verdict is In: Birmingham and the West Midlands are no longer hidden gems; they’re shining stars on the investment map. With a robust economy, a growing population, and exceptional affordability, the region offers an unbeatable combination for building a prosperous and sustainable property portfolio.

While capital gains from appreciating property values are a well-known draw, investing in Birmingham and the West Midlands unlocks a treasure trove of additional benefits:

Predictable Income Stream: Imagine a steady flow of income, month after month. Renting out your property in this thriving region creates a reliable passive income source, supplementing your retirement income or serving as a financial safety net. This predictable income stream can also be reinvested into your portfolio, accelerating your wealth creation journey.

Portfolio Diversification Powerhouse: Don’t put all your eggs in one basket! Property acts as a powerful diversifier, reducing your overall portfolio risk. Unlike stocks and bonds, property prices often move independently, creating a hedge against market fluctuations. This diversification is crucial for building a resilient and balanced investment portfolio.

Tax Advantages at Your Fingertips: Navigating the tax maze can be tricky, but with strategic planning and a knowledgeable accountant, you can unlock valuable tax benefits. Remember, seeking professional advice is key to maximising your tax efficiency.

Tangible Asset: A Sense of Security: Unlike the elusive nature of stocks, property offers a tangible presence. You can see it, touch it, and even call it home. This tangibility translates to a sense of security and control, knowing you have a physical asset with intrinsic value. It’s a comforting feeling in an ever-changing financial landscape.

Beyond Financial Gains: While financial rewards are enticing, remember the holistic benefits of owning property. Whether it’s the pride of ownership, the potential for community building through responsible rentals, or the joy of creating a legacy for future generations, property investment can enrich your life beyond the balance sheet.

So, is Birmingham and the West Midlands the investment haven you’ve been searching for?

With its potential for capital gains, consistent rental income, portfolio diversification, tax advantages, tangible security, and inflation protection, the answer might just be a resounding “yes.”

Remember, thorough research and professional guidance are key to unlocking the full potential of your property investment journey.

By carefully considering these factors alongside the undeniable potential of Birmingham and the West Midlands, you’ll be well-equipped to make informed investment decisions and confidently navigate your journey towards property success.

But hold on one second, surely nothing is all upside is it? While Birmingham and the West Midlands offer undeniable investment potential, it’s crucial to approach with a clear-eyed understanding of the challenges involved.

Here’s a balanced look at some cons to consider:

Rising mortgage rates: Putting pressure on landlord profitability and potentially leading to rent increases.

Tax changes: Increased taxes and restrictions impacting buy-to-let attractiveness.

Energy efficiency regulations: Potential costs for landlords to comply with new standards.

High Upfront Costs: Don’t underestimate the initial investment. Birmingham’s affordability might not shield you from a hefty financial ask.

Ongoing Expenses: Property taxes, insurance, maintenance, and repairs are ongoing costs that chip away at your profits. Factor these in carefully to ensure positive cash flow.

Illiquidity: Unlike stocks, you can’t sell a property instantly. Be prepared to hold onto your investment for the long term, especially if the market dips.

Management Responsibilities: Self-managing can be a time-consuming burden. Finding tenants, collecting rent, handling repairs, and navigating legalities require dedication and expertise. Consider hiring property managers if you lack the time or skills.

Market Fluctuations: Real estate values aren’t immune to economic cycles. If you need to sell during a downturn, be prepared for potential losses. Diversifying your portfolio can mitigate this risk.

With this in mind, there is still a huge upside potential from investing in Birmingham and the West Midlands area.

Alternative investment avenues in the property industry:

Direct Ownership: This classic approach offers the potential for high returns, but comes with the highest risks and responsibilities. Be prepared for hands-on involvement.

REITs (Real Estate Investment Trusts): These offer a more passive approach, investing in diversified real estate portfolios managed by professionals. Returns are typically lower but steadier.

Real Estate Crowdfunding: Pooling your money with others allows you to invest in individual properties with lower capital requirements. However, due diligence is crucial, and returns can be unpredictable.

Real Estate Investment Groups: Joining forces with other investors provides access to larger deals and professional expertise. However, fees and decision-making processes can be complex.

Remember: Each approach has its own advantages and disadvantages. Carefully assess your risk tolerance, financial resources, and time commitment before choosing your investment path.

Ultimately, Birmingham presents an exciting investment opportunity, but due diligence and a balanced understanding of the pros and cons are crucial for making informed decisions.

Remember, knowledge is power, and meticulous planning goes a long way in securing your financial future through strategic property investment. You can book a free consultation with us here to see how our services could help.

So, pack your bags, do your research, and unlock the potential that awaits in the heart of the UK!

Darren Bridgewater – Director

DNB Future Properties

Comments